The Following Stocks Experienced a Double Digit Gain in the Third Quarter

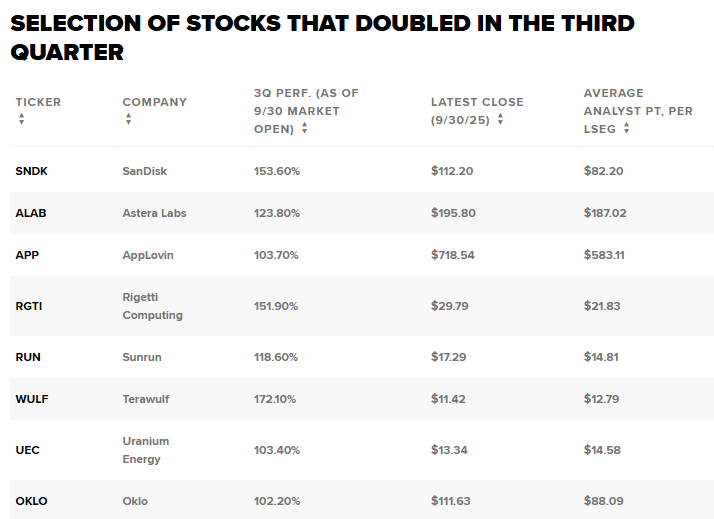

Only a handful of stocks managed to pull off the rare feat of doubling in value during the third quarter, earning them a spot in what traders often call the “100% club.”

Tuesday marked the end of the quarter, and U.S. equities closed out September with strong gains. The S&P 500 climbed nearly 8% since late June, while the Nasdaq Composite surged more than 11%. The Dow Jones Industrial Average also advanced, adding over 5% for the period. Even more notable, September itself delivered an upside surprise the S&P 500 rose more than 3% in a month that has historically been one of the weakest for markets, averaging a 4.2% decline over the past five years.

Despite worries about stretched valuations, heavy concentration in mega-cap names, and lingering macroeconomic risks, the bull market has continued to defy expectations. Along the way, a small group of stocks stood out with triple-digit returns. Many of them were tied to technology and artificial intelligence, areas that continue to dominate market enthusiasm.

Among the quarter’s breakout winners were Astera Labs, SanDisk, Terawulf, and Rigetti Computing, along with several others. Interestingly, analysts’ consensus price targets on some of these names suggest downside risk from current levels, underscoring just how quickly these rallies have run.

Source: LSEG

Astera Labs: Riding the AI Wave

Astera Labs surged nearly 124% in the third quarter, securing its place in the exclusive club. Despite this huge run, Wall Street’s consensus price target suggests limited upside in fact, about a 3% potential pullback from current levels. Still, the stock is up over 45% year-to-date.

The company plays a key role in the AI supply chain, producing semiconductor-based connectivity solutions for cloud and AI infrastructure. Evercore ISI analyst Mark Lipacis has been particularly bullish, reiterating his outperform rating in early August after strong second-quarter results. Calling Astera “an AI pure play in an accelerating capex market,” Lipacis set a $215 price target. Astera ended Tuesday at $195.80.

Rigetti Computing: Betting on Quantum

Rigetti Computing, a quantum computing pioneer, skyrocketed more than 150% over the past quarter. The company remains a speculative name given the early stage of the industry, but investor enthusiasm around the potential is building.

Bank of America recently projected that the global quantum computing market could grow from about $300 million in 2024 to nearly $4 billion by 2030. Rigetti, alongside peers IonQ and D-Wave Quantum, is among the few “pure play” ways to invest directly in the sector.

SanDisk: Storage Giant Makes a Comeback

SanDisk also saw an explosive rally, with shares jumping nearly 154% in Q3. The momentum carried into the final session, when the stock gained another 9% on news that it has started production at a semiconductor plant in Japan. The move is expected to boost capacity and meet accelerating global demand for data storage.

Other Notable Winners

- AppLovin more than doubled, with shares up over 103% in Q3, though analysts’ price targets imply the stock could cool off.

- Sunrun, a solar energy provider, gained nearly 119%, fueled by optimism in renewable energy despite sector volatility.

- Terawulf, a crypto-mining and energy technology company, posted the strongest rally of the group, soaring 172%.

- Uranium Energy benefited from growing interest in nuclear power, advancing over 103%.

- Oklo, a next-generation nuclear fission company, also joined the 100% club, up more than 102%.

The third quarter was far from ordinary. A handful of high-growth names, particularly in technology, artificial intelligence, and alternative energy, produced staggering returns. However, investors should tread carefully several of these stocks now trade well above their average Wall Street targets, raising the risk of near-term pullbacks.

Still, the Q3 “100% club” highlights the outsized opportunities that can emerge in a bull market, especially in sectors tied to disruptive innovation. For investors willing to embrace volatility, these names serve as a reminder of how quickly momentum can build when enthusiasm meets opportunity.

Subscribe to our newsletter!

As a leading independent research provider, TradeAlgo keeps you connected from anywhere.